Hi YXI friends,

Nearly everyone is disappointed that Bitcoin never reached $100k in November. Was this a temporary glitch, or did it signal the top?

Today, we evaluate Bitcoin’s potential for a year-end rally through a detailed analysis of its seasonality, relationship with Global Liquidity, ETF flows, and price chart technicals.

Let’s dive in!

Table of Contents

DISCLAIMER: This newsletter is strictly educational. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice.

1. December Seasonality Is Mixed

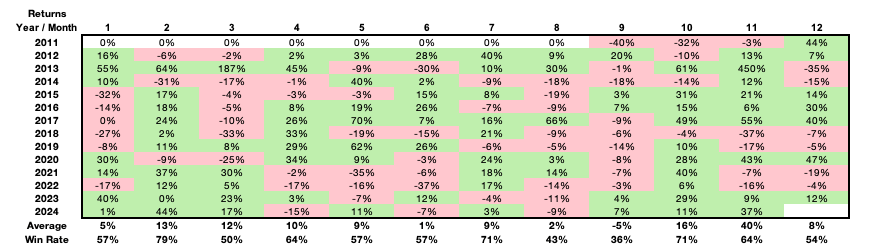

Bitcoin tends to do very well in February, July, and October, with more than 70% success in these months over the last ten years. In contrast, August and September are poor performing months with less than 50% win rate.

Historically speaking, December appears mixed for Bitcoin. Since 2011, there have been 7 up years and 6 down years.

However, there are favourable factors for this December specifically. Looking at the history, almost every time when Bitcoin rose both in October and November, the momentum carried Bitcoin higher in December (2015-17, 2020, 2023). 2013 was the only exception among the 6 occasions.

Furthermore, Bitcoin has always closed December in green on halving years. Halving refers to when the Block Rewards get reduced by half, after every 210,000 blocks. The previous halving occasions were November 2012, July 2016, and May 2020. This year, we had Bitcoin halving in April. But I would warn that given the halving occurs at different months of the year, there should be less of a deterministic impact on how December fares specifically.

2. Bitcoin versus Global Liquidity

There is not a “formal” definition of Global Liquidity. Here we use the M2 money supply of the world’s five largest economies to approximate Global Liquidity: the US, China, Eurozone, UK, and Japan. The measure is denominated in US Dollars, i.e. the $92 trillion USD is our latest available reading.

Global Liquidity has “contracted” since September not because of less money printing, but because of a surge in the US Dollar strength. This is relevant as Bitcoin is quoted against USD (or equivalently pegged stablecoins).

When we map out the Bitcoin price versus Global Liquidity, it becomes quite clear that there is a strong directional relationship, but with many weeks of lag. We estimate the lag to be 10-11 weeks for Bitcoin, and 3-4 weeks for Gold.

The Global Liquidity most recently peaked in the week of September 30th. We are approaching the 9th week from that peak. It means the next 2-3 weeks correspond to a potential local top in Bitcoin. It doesn’t mean the price will falter straight away, but Bitcoin may find it harder to climb after the New Year.

3. Bitcoin ETF Flows

Bitcoin ETFs have enjoyed a tremendous inflows since mid-October, pulling out of this summer’s valley of despair. In the latest quarter, IBIT alone has seen a similar inflow to QQQ ($11 billion). While much of the bet has been fuelled by Trump’s pro-crypto rhetorics, I did think Bitcoin was heading higher regardless of the election outcome. This was well illustrated by both our long and short-term setups in Bitcoin as well as in Ether and COIN.

However, positive ETF inflows do not carry the forever. Very often, we can see opposite price actions to flows. This is because some investors like to take profit or “rebalance” (i.e. outflows) when prices surge quickly, or add risks (i.e. inflows) when prices drop. We want to keep a keen eye on if the momentum wanes from here.

4. Price Technicals

Bitcoin Daily (https://www.tradingview.com/x/qsrzLdVv/)

Overall, we are in the final leg of the wave circle-1 from the 2023 low. This wave 1 has taken the shape of a leading diagonal, in which the 5 sub-waves are all composed of 3-waves.

Having had a trade setup at $57k, we have now exceeded our original target of $92k, but I’ve kept the trade alive to bank on more potential gains. However, I do think the easiest majority of the gains are now behind us. From here, we need to be on our toes.

My first dissatisfaction with the price structure here is a lack of a big wave circle-b pullback after the election. But it’s not uncommon to have such a shallow pullback on the upswing. We saw this in November 2023 and February 2024.

If $90.6k stands - the wave (ii) low - we should be heading towards the final target of $119k in a direct fashion from here. It represents a 23.5% gain versus a 5.5% stop loss.

Going below $90.6 I will need to reassess whether this was a delayed wave-b pullback or maybe just a deeper wave (ii).

5. Putting It Together

Combining our seasonality analysis, global liquidity lag, ETF flows, and technical analysis, I favour us getting to the $119k target before the year-end.

However, whether we get to that target or not by the New Year, I would get very cautious because of the negative liquidity impact from January.

Finally, please remember that nobody ever gets the timing right all the time. My expectation is probabilistic based on known information. I am more than happy to change my mind should price action violently disagree with me or new information emerges.

Tools I find helpful:

Growth Investor Pro (GIP) on Seeking Alpha: I have been writing on Growth Investor Pro by Cestrian Capital Research for over 4 years. GIP is a tech-focused investing group which offers pro-grade research that finds opportunities to make money in any market. Sign up here to receive a 20% discount on the Growth Investor Pro membership.

Seeking Alpha: I am the dedicated FOMC Commentator on Seeking Alpha News. Seeking Alpha provides in-depth investment news, research, and analysis to 250k+ members. Sign up here to get $25 off your Premium Membership (7-day Free Trial).

TradingView: I use TradingView for all my chart analysis. It is very fast and simple to play with, including the mobile and desktop apps. Sign up here to get $15 off your new TradingView plan.

Koyfin: I use Koyfin for stock screening, comparative analysis, and fundamental analysis. It provides very comprehensive data and features at a reasonable price. Sign up here to get 15% discount off all Koyfin plans.

Fastgraphs: I find Fastgraphs very useful in gauging whether a stock is underpriced or overpriced versus the fundamentals. Sign up here to get 25% off using the coupon “AFFILIATE25” at the check out.

(Disclaimer: I am an affiliate of the above service providers and receive a commission from new signups.)

A quick “Thank You”

I really appreciate your support for this newsletter.

Please feel free to share any suggestions or comments, either directly through email or DM me on X

— Yimin

I'm on X to share actionable trade ideas on

🏦 Fixed Income (Treasury ETFs, BDCs, Fed Funds)

🖥️ Mega-cap Tech & Financial Stocks

🪙 $BTC & Crypto Stocks

Plus insights on $TNX, $SPY, $QQQ, $IWM, FOMC, NFP, CPI, PCE

— #Yimin Xu (#@yxinsights)

11:08 AM • Jul 23, 2024