Hi YXI friends,

What an FOMC day it was. After the FOMC, yields shot higher across the curve, repricing the higher than expected projections for inflation in 2025 and 2026 by the Fed.

The stock market also completely faltered, with SPY, QQQ, and IWM down 3-4%. These were 3+ standard deviation moves from their 1-year daily volatilities, theoretically occurring less than 0.1% of the time.

What really happened? Why was the market caught off guard by the FOMC? Is the risk now higher yields for longer? Is the Santa Claus rally now off the table?

We answer all these questions by carefully walking through the macro context and the market dynamics before and after the meeting.

Table of Contents

DISCLAIMER: This newsletter is strictly educational. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice.

1. Context: The Market Expected A Cut And Pause

Ahead of yesterday’s December FOMC, the Fed Funds Futures market had already priced in 90% chance of a cut for the meeting, which is as good as 100%.

The futures market saw a near 100% chance of a pause for January, which finalised its shape after the latest set of PCE data in the last week of November.

More importantly, the market saw just two 25bp cuts for 2025.

Why?

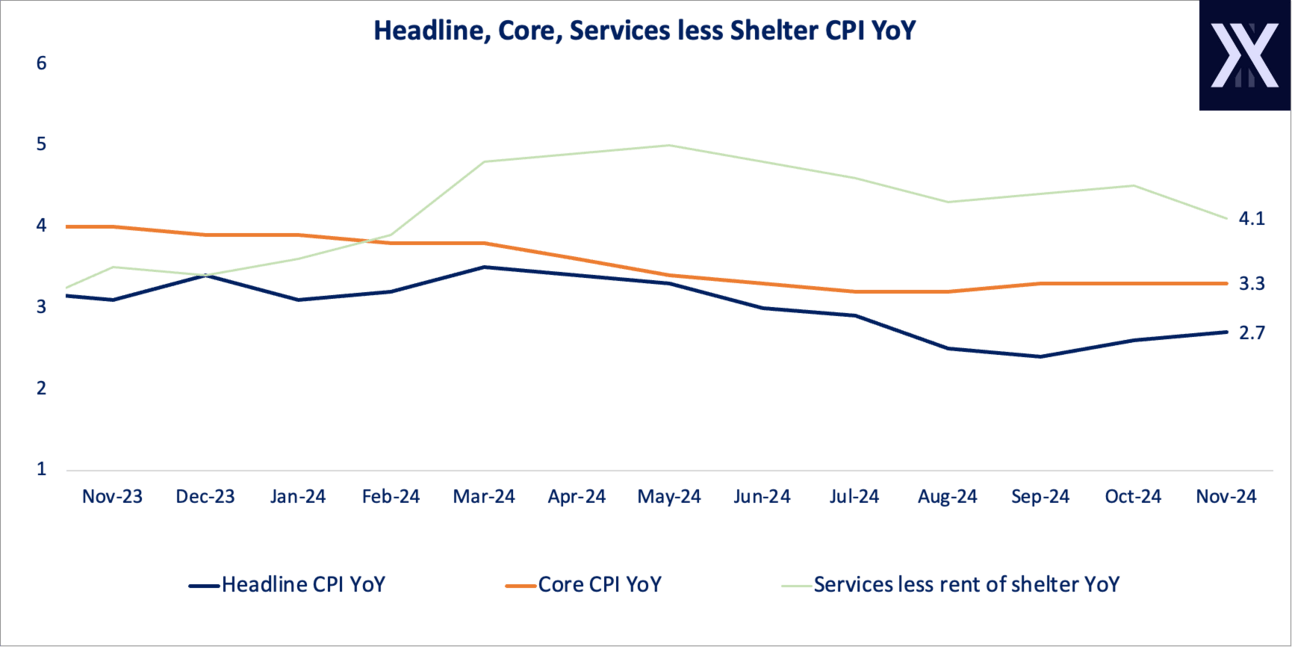

Inflation readings remain high

Firstly, the recent PCE showed that both the headline inflation and core inflation accelerated upwards in October, away from the Fed’s 2% target.

Most notably, Core PCE (in red) bottomed at 2.6% as early as June. It has been sticky for over a quarter now.

The mid-month CPI print for November showed a similar story of a sticky Core CPI and an upwards Headline CPI.

For those who wonder about the difference between CPI and PCE, CPI is simply the inflation reading from urban areas, while the PCE encompasses both urban and suburban price levels. Therefore, they measure different items and place different weightings on these items in their calculations.

Trump’s incoming tariffs

Secondly, Trump’s tariff policies are seen as inflationary, as they are effectively import taxes that raise the prices of imported goods.

The chart above shows close relationships between the 10-year UST yield (blue) and Spot 5-year inflation expectation (red), and between the USO ETF (yellow) and the 5-year 5-year forward inflation expectation (green).

As the market started pricing in a Trump victory in October, the Spot 5-year inflation expectation rose significantly from 1.85% to today’s 2.38%, driving the 10-year yield relentlessly higher.

The forward-forward inflation expectation is more linked to oil prices, which have been moving sideways. However, a recent bounce in oil prices coupled with strong nonfarm payrolls data have also driven up the forward-forward inflation from 2.16% to 2.26%.

Nonfarm Payrolls Are Cooling But Stabilised

Remember the market sold off amidst the carry-trade unwind in August after unemployment rate spiked to 4.3% in the July NFP data?

Unemployment rate has remarkably stabilised at 4.1-4.2% since, with two 200k+ non-farm net jobs added in the past three months.

The Fed is very pleased with this positive development, which allows them to refocus on inflation.

2. The FOMC Surprised The Market With 2025 Projections

Now given all of the above, you may begin to wonder, why did the Fed cut at all?

Powell described the decision as being “close” . Ultimately, the Fed stuck with their original script and cut rates to prevent a rapid deterioration in the labour market.

It should be noted that Beth Hammack of the Cleveland Fed dissented, believing the Fed should have maintained the rates at the 4.50-4.75% range.

From here on, we likely see regular dissents from the FOMC members, as they navigate the tricky balance between fighting inflation and saving maximum employment.

The Fed’s Dot Plot

The renewed Dot Plot, a visual guidance of where the individual FOMC members believe rates should be in the next 3 years, shows 2 cuts for 2025, followed by another 2 cuts by 2026.

Given the numerous market swings and Dot Plot updates, two things are clear:

1) the Fed has a recency bias by making policy decisions based on the latest data, which are subject to a lot of noise, and

2) the Fed is closely following the market interpretation of the data and therefore policy projections. The Dot Plot updates for 2025 throughout this year were exactly where the market had priced.

So far, so good. What’s the surprise?

Higher Inflation Projections For 2025 & 2026

The nasty surprise hid amongst the median projections for PCE and Core PCE next year, in the quarterly Summary of Economic Projections.

While the Unemployment Rate was nudged a tick lower than September, the median PCE Inflation project was revised up from 2.1 to 2.5% for 2025. This was not only a big jump, but also meant that the Fed thinks inflation will in fact get worse next year, compared to its September projection of moving from 2.3% in 2024 to 2.1% in 2025.

Core PCE was also revised higher from 2.2% to 2.5% for 2025. Moreover, for 2026, Core PCE was also projected to be above target, at 2.2%.

In essence, the Fed admitted yesterday that the fight against inflation will take at least a year longer than they expected back in September.

Trump Trade War Too Early To Predict, But Some People Are Trying

In the November FOMC, right after Trump won the US Election, Powell said it is too early to make any useful modelling projections for the impact of Trump’s new policies next year. The Fed does not know the timing and the extent of these policies and therefore does not want to front-run their impact.

The Fed can borrow lessons from the the 2018 playbook. However, the macro context is quite different.

FRED

The Fed is now in a cutting cycle compared with a hiking cycle under Trump’s first term.

The US also runs a smaller trade deficit with China than 6 years ago.

source: census.gov

Powell admitted in the FOMC Press Conference that some, but not all, of the members have incorporated their views on Trump’s potential policies in their economic projections. This explains why the numbers were higher than the market expected.

3. Yields Bear Steepened

Current FOMC Path Priced By Futures Market

Let’s start with the short-end Fed Funds futures (up to beginning of 2026). The futures market predict just another 40bp of cuts in the next year.

The terminal yield is now priced at 3.93%, about 30bp higher than the beginning of the month.

FOMC Date | Before Meeting | Post Meeting | Hike/ Cut in % |

|---|---|---|---|

12/18/24 | 4.58 | 4.33 | -0.25 |

01/29/25 | 4.33 | 4.33 | 0 |

03/19/25 | 4.33 | 4.18 | -0.15 |

05/07/25 | 4.18 | 4.13 | -0.05 |

06/11/25 | 4.13 | 4.13 | 0 |

07/30/25 | 4.13 | 4.03 | -0.1 |

09/17/25 | 4.03 | 3.93 | -0.1 |

11/05/25 | 3.93 | 3.93 | 0 |

12/17/25 | 3.93 | 3.93 | 0 |

01/28/26 | 3.93 | 3.93 | 0 |

In terms of timing, the market thinks that the Fed will pause in January, cut in March, pause again in May and June, before an equal chance of cutting in July or September.

If the sequencing is about right, I would probably see September being more favourable than July for cutting, after Jackson Hole, which is what happened this year.

SOFR 3-Month Yields

In rates, “bull” means the bond / futures price go up and yields fall, while “bear” means the opposite. “Steepen” means longer-end yields’s move were higher than the shorter-end. “Flatten” means the opposite.

After the FOMC, rates bear steepened. The latest SOFR 3-month yields (in blue) moved 10-16bp higher across the curve compared to pre-FOMC (yellow). The longer end (2028-29) rose faster than the shorter end (2025).

It shows the market is preparing for higher rates for a very long time.

US Treasuries

Longer term bond yields also rose, with the 7-year outright yield up 16bp, and 10-year outright yield up 15bp.

However, the moves were concentrated in the 3-7 year region, measured on a forward-forward basis.

Yields in the 3-7 year forward region are up a whopping 20bp, while the 10-30 year forward yields only 13bp.

This means that while TLT fell, the impact was actually somewhat restrained.

TLT Daily (https://www.tradingview.com/x/8OJmtPib/)

From a price technical level, we appear to be in wave C of (C) of circle-B for TLT.

The rational for the current pricing, apart from the cited inflationary risks, is also the fiscal deficit risk, where the US Treasury bloods the market with longer-end bonds with limited demands.

As Fed continues its QT and removes itself as the largest buyer of Treasuries, bank reserves begin to look constrained for scooping up long-end Treasuries in size.

Yellen has been stealthily funding the ever-widening budget deficit through short term bills rather than notes and long-end bonds, as seen in the intense bill issuances since Q1 of 2023.

The effect is that the long-end yields are “suppressed”. Scott Bessent, the incoming Treasury Secretary, is an excellent macro hedge fund manager who is acutely aware of this situation. The budget deficit issue is at the front and centre of his mind, despite the best effort from the the current establishment trying to scare investors about a greater budget deficit from tax cuts.

In practical terms, Bessent will likely continue printing short-end bills to buy time for Elon Musk’s DOGE initiative to cut government spending and not scare the longer end bond investors.

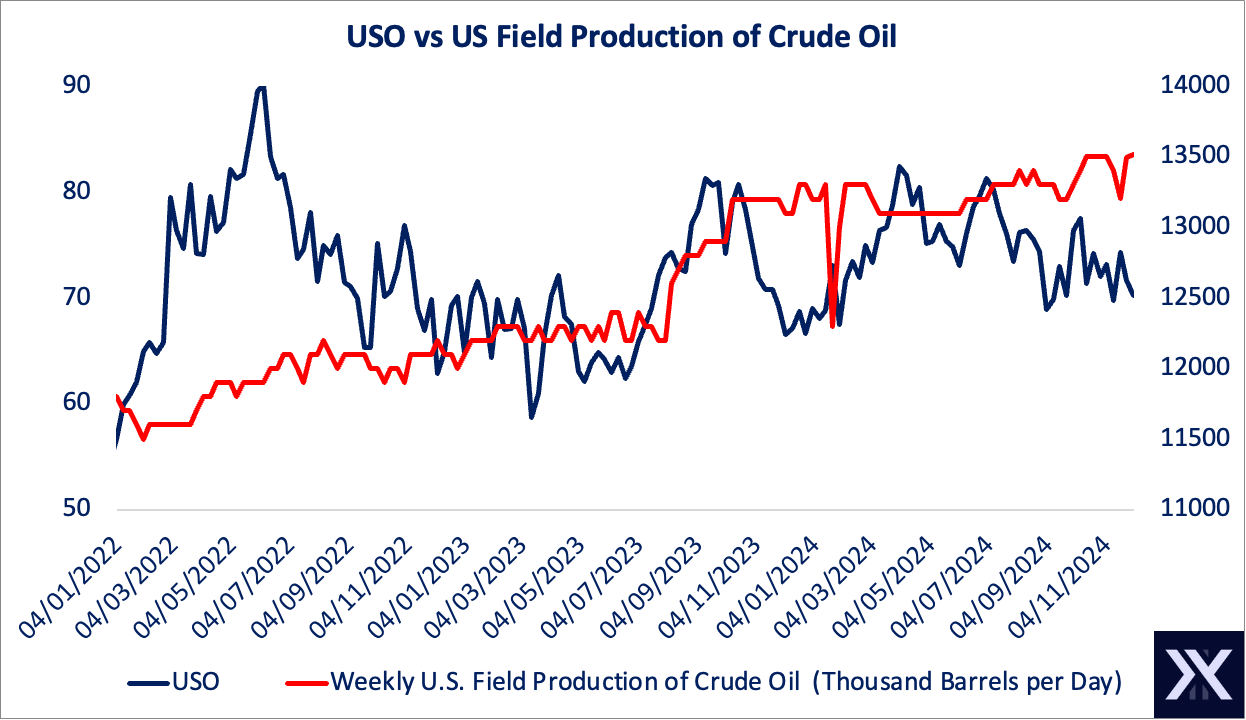

Moreover, Trump understands that the Democrats lost the Election on the economic front essentially because people were angry about high inflation. I think the plan is likely to 1) use tariffs as an aggressive negotiation tool vis-a-vis countries like China, the EU, and Mexico, and 2) encourage domestic oil production to push up oil supply and push down energy prices.

Tariffs should have a one-time inflationary effect - you raise the tariffs and everything becomes expensive in year 1, but inflation will fall back in year 2 as the year 1 data get lapped.

Regarding oil, US is now the largest oil producer in the world. For the past 3 years, oil prices have been range bound (USO mostly oscillating between $60 and $80), coinciding with a big ramp up in the production of crude oil in the US (in red). It is likely that Trump will focus on offsetting the inflationary effect of the tariffs through lower energy prices.

4. Where Is The Bottom For TLT

This is an YX Insights Premium note. You can claim your free 7-day full-access now!

Claim Your 7-Day Free Access To YXI Premium

Unlock YX Premium to access this post and other valuable subscriber-only content.

Unlock Premium NowA subscription gets you:

- Access actionable trade ideas to capitalize on immediate market moves

- Make informed decisions with institutional grade insights on market trends and single names

- Gain real understanding of market drivers through weekly, in-depth video briefings

- For Slack discussions, live chart updates, and intraday Q&As with Yimin, please sign up via Cestrian: https://www.cestriancapitalresearch.com/the-macro-perspective/