Hi YXI friends,

Today we are diving into the latest price action of Bitcoin, COIN, Ether, Solana, and Ripple.

We first review what happened in December, with an observational explanation on what drove the moves. In the second half of the article, we perform an in-depth analysis of the price charts to get a sense of where prices are moving.

Table of Contents

DISCLAIMER: This newsletter is strictly educational. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice.

1. A Month Of Two Halves

At the beginning of the month, when Bitcoin was $95k, I expected a Santa rally. Bitcoin swiftly broke a all time high, reaching $108k the day before the FOMC.

And what an FOMC that was. The widely anticipated non-event wrongfooted the market completely, with the Fed moving up inflation expectations significantly for 2025. Half of their rationale was based on the latest resilient inflation data, but the other half was based on the FOMC members’ expectation of Trump’s potential tariff plans.

Of course, Trump has not yet made any concrete tariff or tax cut announcement, because he is not actually in the Oval Office until January. My bet is that his plans will “disappoint” the market, meaning the Fed and the market are probably overpricing some of the worst case scenarios, especially around inflation.

Why?

Scott Bessent, the incoming Treasury Secretary and an excellent macro hedge fund manager, understands the importance of managing inflation, the budget deficit, and not upsetting the bond market. It is difficult to see him letting Trump’s policies run wild. JD Vance, the incoming Vice President, has ambitions of running for the top job in 2028. He also would not want to see inflation being flamed up again which will for certain destroy his chance of success.

However, the FOMC did turn the December rally across stocks and crypto on its head. And that’s what we have to deal with. The Santa rally became a distant dream, with Bitcoin now trading back down to $94k.

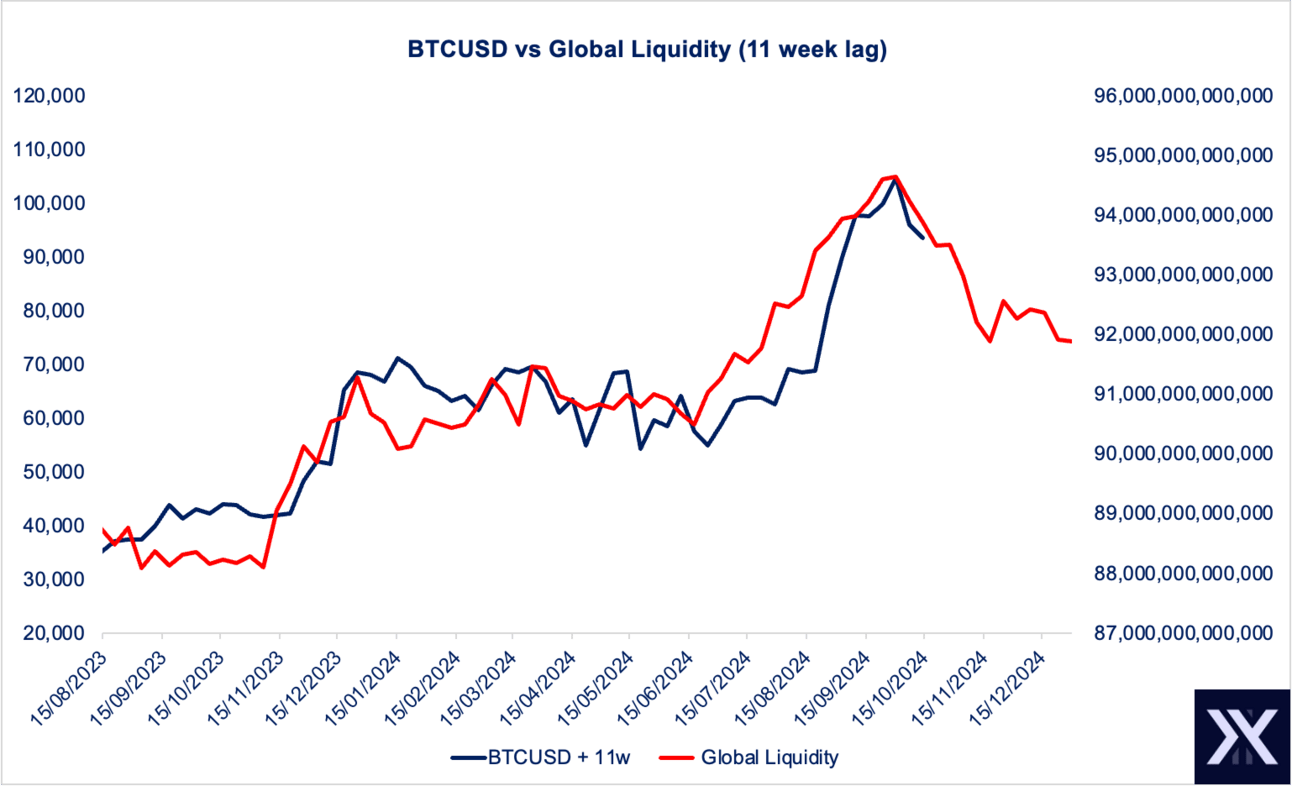

2. The Most Crucial Chart - Global Liquidity

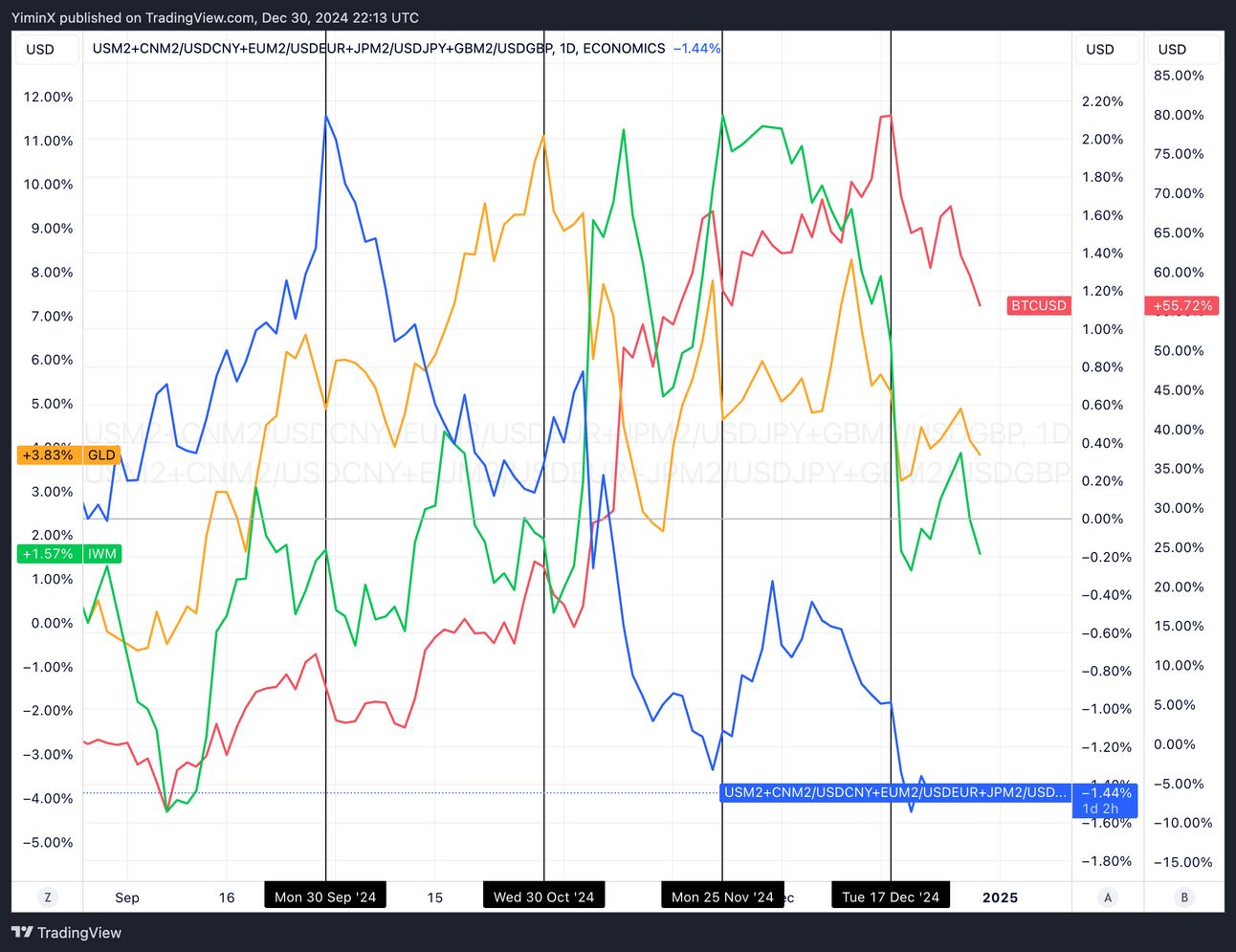

Global Liquidity here is being approximated using the M2 supplies of US, Eurozone, China, UK, and Japan. One could throw in more countries in here, but I find these 5 regions can explain a great majority of the picture.

Bitcoin trades with an 11 to 12-week lag to Global Liquidity.

Nobody really knows why this precise time frame. My best guess is rotation, as excess liquidity first works through gold, then growth names, and eventually into the more speculative corners of the financial markets like crypto.

On this messy chart above, we have the Global Liquidity (Blue), GLD (Yellow), IWM (Green), and BTCUSD (Red). We can see that Global Liquidity peaked on September 30th. Exactly a month later on October 30th, GLD peaked. IWM subsequently peaked on November 25th. Finally, BTCUSD’s latest all time high was seen on December 17th.

The charts above suggests Bitcoin may have topped in the near term, and could follow the path of Gold and Silver in the coming weeks. Note that I did not say “topped completely this cycle”, just as I believe Gold, Silver, IWM are all in a wave 4 correction and have higher room to climb.

Should this be the case, the strategy should flip to selling into strength when Bitcoin rebounds.

Of course, “nobody rings the bell” at the exact top - nobody has come forward to admit this is exactly what they did with big money. A lot of the analysis is deductive reasoning from cross-asset observations. That’s why we will also examine a number of other observations and factors too.

3. Price Is Falling On Low Volumes

What is notable in the latest episode of the price free fall is the lack of volume.

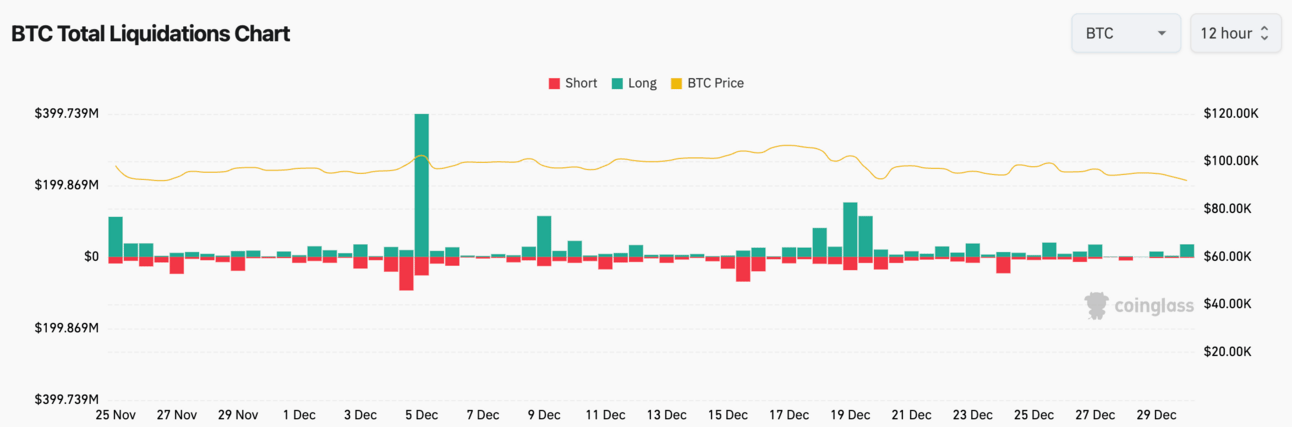

If you look at the December 5th boom & bust, there was huge amount of volume as Bitcoin bursted through $100k but immediately retreated down to $92k. Both the leveraged shorts were busted in the morning and the leveraged long in the evening, to the tune of over $450 million in 24 hours (and over $1 billion together with ETH, SOL and alts). There is also notable volume after the FOMC, as the leveraged longs got liquidated.

However, in the more recent days around Christmas, trading volumes were fairly muted.

The Liquidation chart from Coinglass for Bitcoin tells a similar story. There was plenty of liquidation of the leveraged longs right after FOMC, but it has been very muted in the past week.

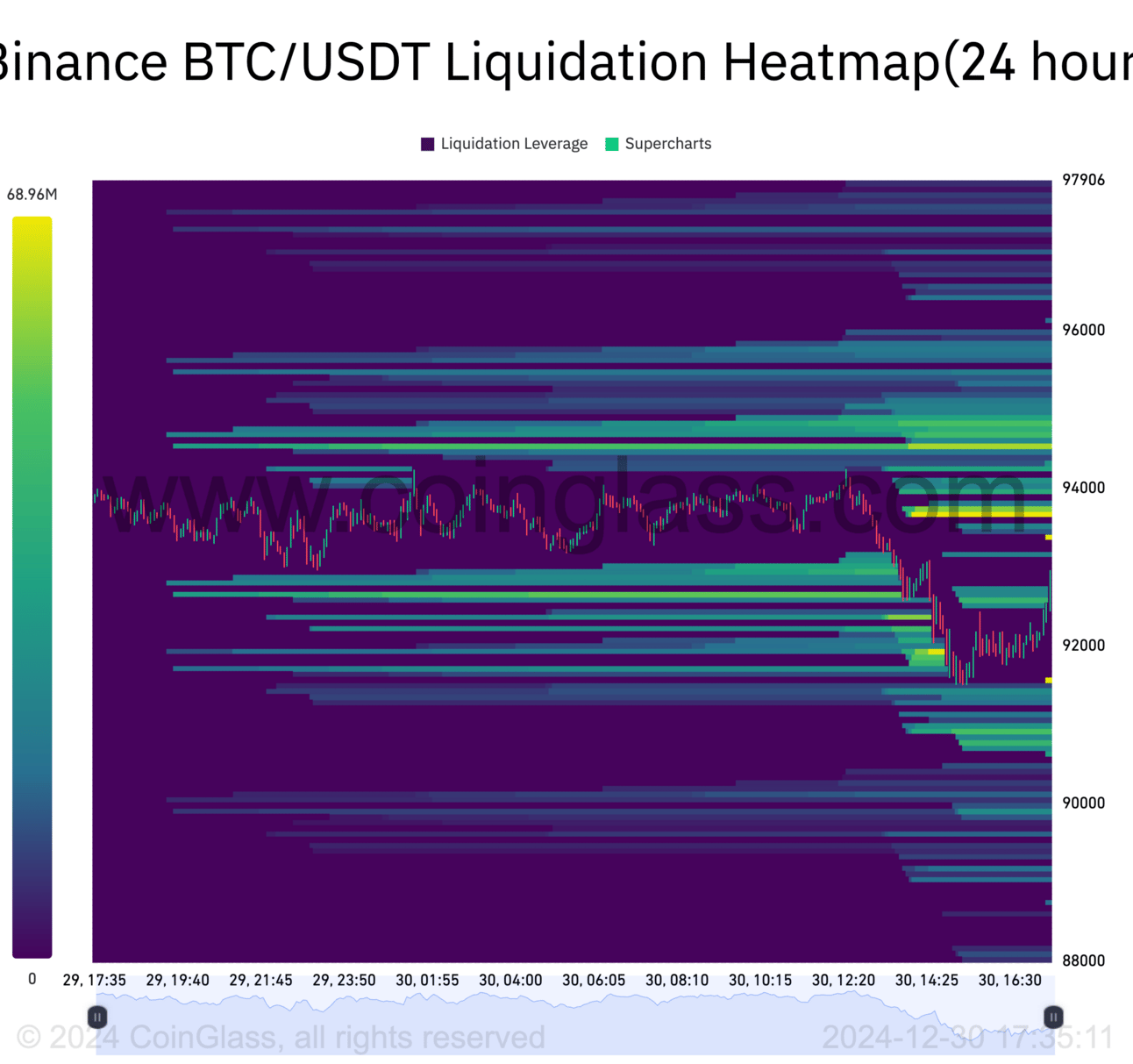

The Liquidation Heatmap by Coinglass predicts the price levels at which large-scale liquidation events may occur. The importance is in the colour shade - the brighter the shade, the higher the liquidation volume at a particular price.

The Heatmap above suggests that a lot more leveraged short will get liquidated at $93.5-$95k than the leveraged longs below $91k.

Overall, the conditions are prime for a short-term rebound.

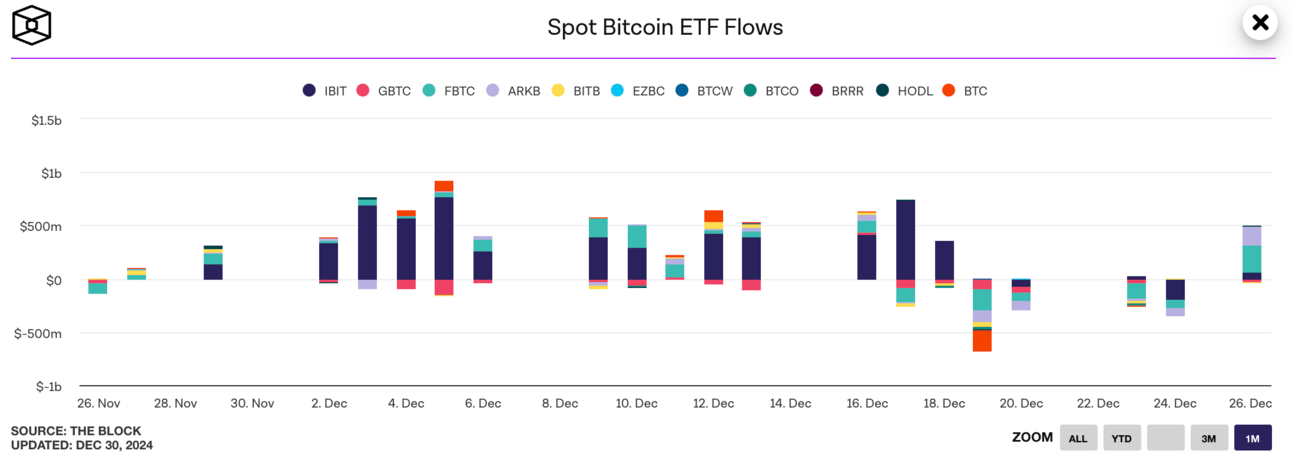

4. ETF Outflows After The FOMC

Bitcoin ETFs provided some significant selling pressure in the past 10 days.

ETF flows were strong in December until the FOMC. Unfortunately, we saw $1.5 billion of outflows between the FOMC and Christmas day.

However, we did see a $500 million rebound in ETF flows on Boxing Day, suggesting institutional investors could be back to buying the dip.

5. BTCUSD Price Technicals

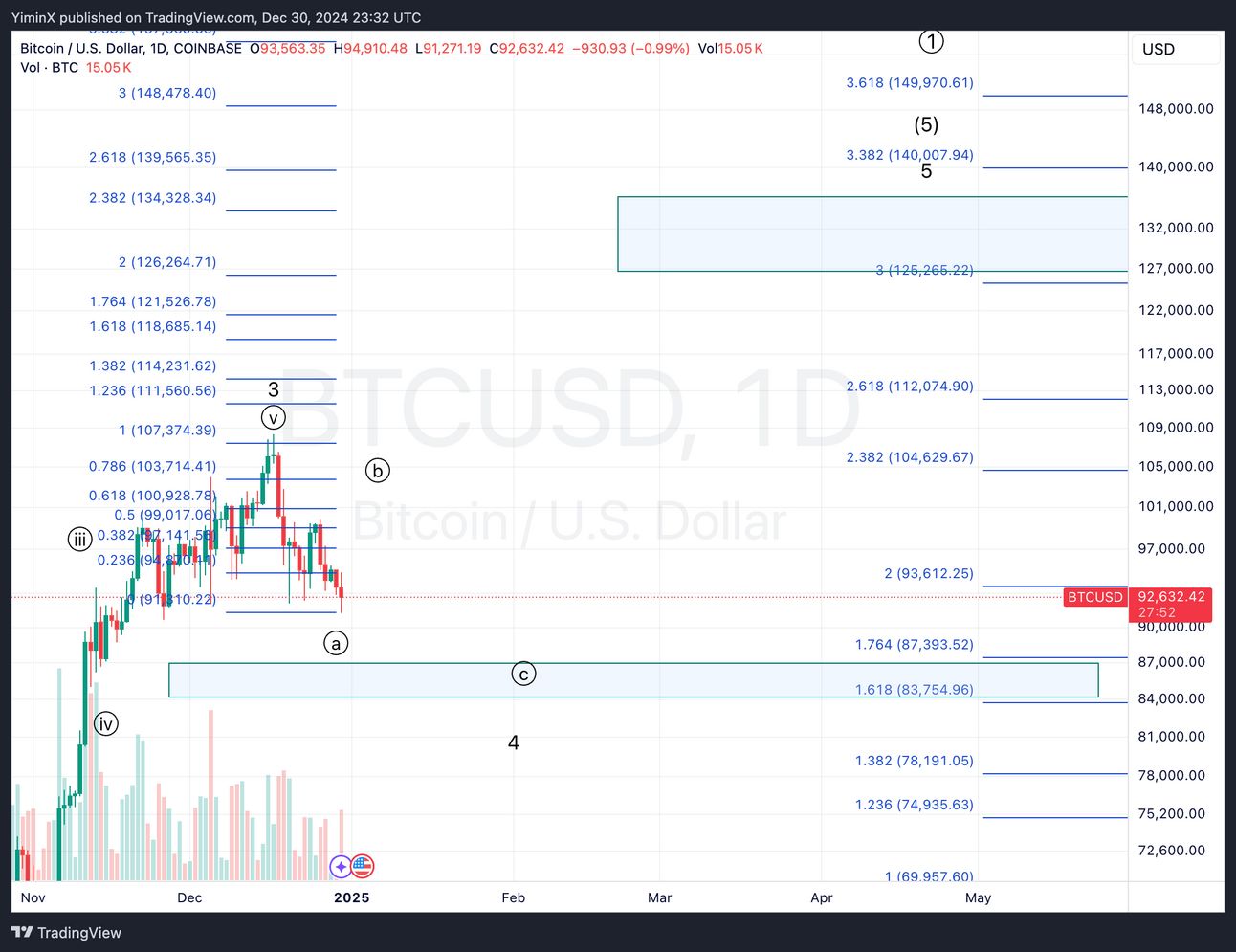

There are different possible paths for Bitcoin, I am presenting what I think currently is the strongest possibility given all of the price action since our last update.

Moreover, I periodically refresh my entire chart to double check my thinking. Therefore, the below charts appear different to the previous analysis - my apology in advance if this looks confusing or conflicting.

BTCUSD Daily 1 (https://www.tradingview.com/x/orD7qJBX/)

The most important highlight of the chart above is that we are now most likely in wave 4, which could go as far down as $83-87k before completion.

It’s not the scenario we would have liked before the FOMC, but the lower lows and lower highs we are getting, combined with the Global Liquidity chart suggests further headwinds in the next two months.

BTCUSD Daily 2 (https://www.tradingview.com/x/VK4bfMLT/)

Judging by the declining volume, the fairly well-supported 92k level, and an asymmetrical liquidation heatmap (from earlier), we should get an immediate bounce here for wave circle-b just after the new year. Moreover, it would coincide with a brief side-way movement in Global Liquidity 11 weeks ago.

For reference, GLD saw the start of wave B bounce exactly 2 weeks after its all time high. Moreover, GLD’s wave B made a bounce of more than a 0.618 retrace of the wave A. The equivalent level for BTC is $101k.

If wave circle-b does make past $101k, the final wave circle-c could end around $86k.

Finally, I am still optimistic of a higher, but postponed wave 5 target above $125.

6. Coinbase (COIN)

Claim Your 7-Day Free Access To YXI Premium

Unlock YX Premium to access this post and other valuable subscriber-only content.

Unlock Premium NowA subscription gets you:

- Access actionable trade ideas to capitalize on immediate market moves

- Make informed decisions with institutional grade insights on market trends and single names

- Gain real understanding of market drivers through weekly, in-depth video briefings

- For Slack discussions, live chart updates, and intraday Q&As with Yimin, please sign up via Cestrian: https://www.cestriancapitalresearch.com/the-macro-perspective/