- YX Insights

- Posts

- What's Driving the Market Today? (June 18, 2024)

What's Driving the Market Today? (June 18, 2024)

Unpacking Liquidity, Equities, Rates, and Crypto Dynamics

Hi Market Warriors 🗡️,

Thank you for joining me on this exciting journey of dissecting the US Macro and Equities. Let’s unpack what’s happening in the market today across the board.

If you are only interested in a particular topic, feel free to jump straight in by clicking the topic link below.

Let’s have some fun!

Tools I find useful:

TradingView: I use TradingView for all my chart analysis. It is very fast and simple to play with, including the mobile and desktop apps. Sign up here to get $15 off your new TradingView plan.

Koyfin: I use Koyfin for stock screening, comparative analysis, and fundamental analysis. It provides very comprehensive data and features at a reasonable price. Sign up here to get 15% discount off all Koyfin plans.

Fastgraphs: I find Fastgraphs very useful in gauging whether a stock is underpriced or overpriced versus the fundamentals. Sign up here to get 25% off using the coupon “AFFILIATE25” at the check out.

1. Retail Sales missed the mark

Source: Investing.com

Both the Headline and Core Retail Sales for May came in below the consensus forecast today, at 0.1% and -0.1%. Additionally, April’s figures were also revised down.

10-Year US Treasury yield fell 4bp post the release.

Motor vehicle & parts dealers were up 0.8% from April, reversing the negative print from last month. This category has implications for the CPI due to the importance of motor vehicle insurance. Higher vehicle sales and more expensive parts can lead to increased car insurance costs.

Sales at gas stations were down 2.2%, but this was no surprise given the sliding oil prices in May.

Food services were down 0.4%. This is the only services category in the retail sales report. The Fed is keen to reduce the non-housing services inflation, so this is a positive for the battle against inflation.

Overall, retail spending by consumers continue to cool. This corresponds with a cooling CPI report released early in the month.

Now the big question: will this trend continue, or will consumers regain their spending power over the summer?

2. Fed Speakers: Barkin, Kugler, Collins, Goolsbee

The market is currently seeing two rate cuts before the year end, ahead of the Fedspeak today.

Among the Fed speakers, Barkin (Richmond Fed) and Kugler (Fed Board) are voting members. Their opinions therefore weigh more than the other two.

Collins (Boston Fed) and Goolsbee (Chicago) Fed will rotate into the FOMC next year, by when the rate cuts should be underway.

Here are some of the recent takes by today’s speakers (sources see "References” at the end of the article).

“I am optimistic that today’s restrictive level of rates can take the edge off demand in order to bring inflation back to our target…The full impact of higher rates is yet to come.”

“If disinflation and labor-market conditions proceed as I am currently expecting, then some lowering of the policy rate this year would be appropriate”

“A slowdown in activity will be needed to ensure that demand is better aligned with supply for inflation to return durably…the recent upward surprises to activity and inflation suggest the likely need to keep policy at its current level until we have greater confidence that inflation is moving sustainably toward 2%”

"Inflation was back down to levels that, if we got a lot of months like this, we would be feeling so much better”

It will be interesting to see if any of them have changed their tone after the latest set of positive CPI data.

3. Market Liquidity - Reverse Repo & Treasury General Account

RRP ON Volume remains steady in the $370b - $460 region.

Reverse Repo Overnight Volume, Source: FRED, YX Insights

The Overnight Reverse Repo Program (RRP) is a facility where money market funds typically engage in reserves repo.

The Fed sells securities to a bank, money-market fund, or government-sponsored enterprise to buy them back later at a higher price. The extra amount paid is like interest, making it a loan from the institution to the Fed. This helps keep the Fed Funds rate within the target range set by the FOMC.

If RRP levels rise, it usually means that financial institutions are putting more money with the Fed overnight. The effect is that the Fed is taking in more cash from the financial system, which reduces the liquidity available in the market for other short-term loans and investments.

In the past year, money-market funds have been switching out of RRP to purchase Treasury bills, explaining the steady fall in RRP levels.

In the recent 3 months, RRP have been fairly range bound between $300 and $500 billion. When rate cuts keep getting pushed out, money market funds become more indifferent between overnight lending and short-term bills.

The Treasury General Account continues to decline

Treasury General Account Balance, Source: Treasury.gov, YX Insights

The Treasury General Account (TGA) can be thought of as the main "checking account" for the US government, where the US Treasury maintains and manages its funds to conduct daily operations.

The TGA is maintained at Federal Reserve Banks - the US government deposits its revenue into the TGA and then uses that money to pay for its various obligations. It goes up when it collects tax receipts or issues debt, and goes down when it spends its budget, for example on government worker salaries.

The TGA balance has been declining since its recent peak in April. When the TGA balance falls, the money that the Treasury spends flows into bank reserves, which can increase the overall liquidity in the banking system.

TGA Balance movement correlates with bond yields and stocks

We observe that the decline in the TGA balance has a moderate correlation (between 0.3 and 0.5) with a decline in the 10-year bond yield. This is because as the Treasury spends money, it has a net positive effect on market liquidity. When the Treasury hoards money, financial conditions tend to tighten, and bond yields rise.

The TGA balance at times also has a negative correlation with stocks. In May, the falling TGA balance was moderately associated with the daily rises in both SPY and QQQ. However, this association has become negligible in June.

RRP, TGA, 10-year UST, QQQ, SPY levels past 1 month

4. Interest Rates - Bonds, Fed Funds & SOFR

We look at bond yields, Fed Funds Futures, SOFR 3-Month Futures, as well as the SOFR OIS Curve to get an overview of the market’s projection of future interest rates.

The 10 Year yield has been travelling in a wide upwards channel since the end of 2022. This is because the market (and the Fed) keeps yo-yoing between expecting more hikes, no cuts or a lot of cuts. At the beginning of this year, the market was predicting 7 cuts for 2024. Now the latest Fed Dot Plot indicates that the Fed thinks 1 or 2 cuts are the most likely.

10Y UST Yield

My personal expectation is for the 10-year yield to consolidate side ways for the next two months, before testing the channel support to the downside. This is because the Fed is still not showing their hands on when they will trigger the first cut.

There were little movement in the Fed Funds futures today. Yields for H1 2025 edged lower. The market has put a floor on the Fed’s upcoming rate-cut cycle at just below 4%. Given that the forward inflation expectation is around 2.5%, the market is settling on a real interest rate of 1.5%.

Fed Funds Yield Curve Implied by Futures

The Fed Funds Futures need to be re-interpreted as “FOMC Steps” because interest rate decisions are binary for each meeting. We interpolate FOMC decisions using dates of the FOMC and the futures prices for that month (which are averages of each month’s Fed Funds rates).

The market is expecting two rate cuts this year, in September and December. Both of these meetings release the Summary of Economic Projections which include the Fed’s Dot Plot.

FOMC Steps projected by the Fed Funds Futures

SOFR stands for Secured Overnight Financing Rate. It's a benchmark interest rate used for short-term dollar-denominated loans and derivatives. Since 2023, it has replaced LIBOR (and Eurodollar Futures).

Interest Rate Curve implied by SOFR 3M Futures

Today, SOFR yields have fallen across the curve, with the front-end falling faster than the far-end, i.e. small bull-steepened.

Bullish / rally in bond markets means yields lower (prices higher), while bearish / sell-off in bond markets means yields higher (prices lower).

The SOFR IOS Curve below shows the longer tenors, as of yesterday’s close updated on the CME. Again, the yield curve is fairly elevated versus the low interest rates we enjoyed between the Financial Crisis and COVID.

5. ETFs: SPY, QQQ, IWM, Sector, Bonds, Commodities

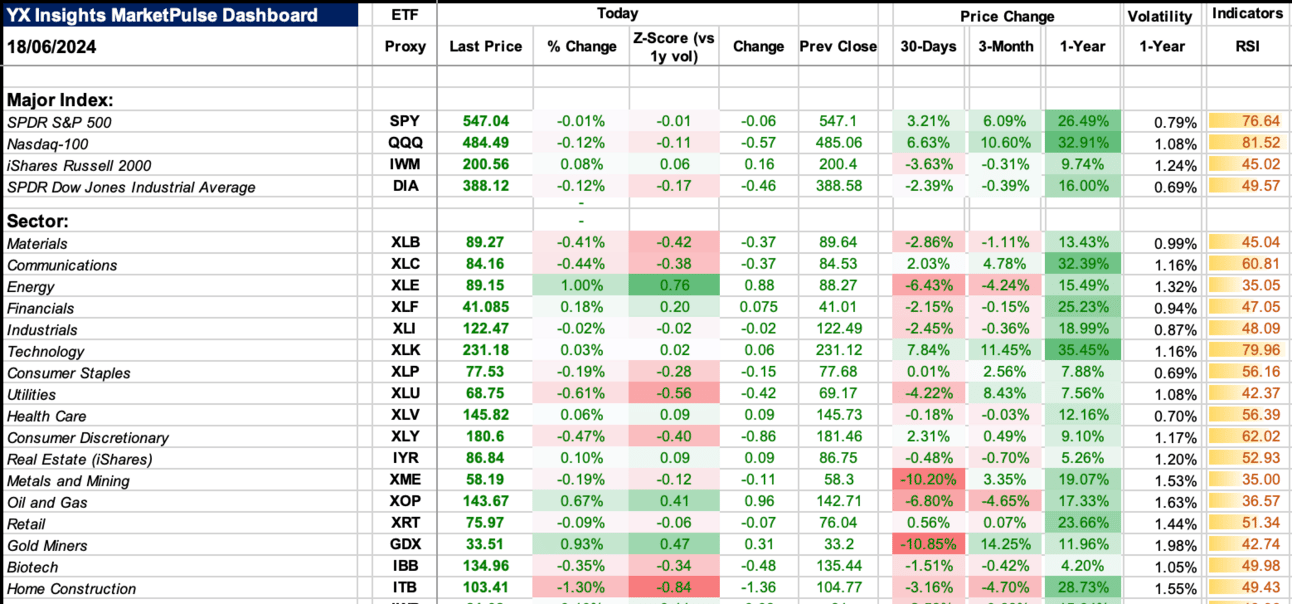

Equities are fairly muted today. May and June are seasonally tight months, but this year SPY and QQQ have shown nothing but strength.

In contrast, IWM (Russell 2000) has significantly lagged.

ETFs, June 18, 2024

A word of caution here would be that both SPY and QQQ are showing high Relative Strengths (RSI), indicating at least an overbought condition in the short-term.

Energy, metals and mining, oil and gas, and gold miners were very beaten down in the past month.

Bond ETFs, June 18, 2024

Bond ETFs are muted given the little movements in yields. ZROZ has been bouncing back lately as longer-end yields continue to fall on positive inflation data.

Oil (USO) and Natural Gas (UNG) ETFs are rallying higher as the WTI just broke above $80.

6. The Magnificent 7: AMZN, AAPL, GOOGL, META, MSFT, NVDA, TSLA

NVDA and TSLA further diverged today.

$NVDA trades at a higher EV/ Revenue (NTM) multiple than $TSLA, i.e. 25x vs. 6x.

But when you account for their projected growth rates, 60% 2-year CAGR for $NVDA versus 10% for $TSLA, NVDA is actually more attractive in growth-adjusted terms.

NVIDIA enjoys a 76%s gross margin… x.com/i/web/status/1…

— Yimin Xu (@yxinsights)

8:34 PM • Jun 17, 2024

After a relentless 200% rise in the past year, NVDA has only just come in line with other Magnificent 7s in terms of forward growth adjusted EV/ Revenue (NTM) multiples.

Source: Koyfin, YX Insights

Apple is also expensively priced due to the lack of growth rate - until Apple Intelligence seriously reboot the iPhone & iPad sales.

AMZN is the most attractively priced in terms of growth-adjusted forward EV/ Revenue multiple.

Source: Koyfin, YX Insights

When it comes to margins, NVDA, MSFT and META are the top performers. TSLA has very miserable gross and EBITDA margins, while AMZN has a low EBITDA margin that explains the low EV/ Revenue multiple.

Back to the NVDA vs TSLA comparison, NVDA enjoys a 76% gross margin and is already printing a tonne of free cash flows. However, TSLA has a gross margin in the teens and needs to burn a tonne of capital expenditure on the other end to get to Elon’s grand vision.

Source: Koyfin, YX Insights

Finally, when looking at the P/E vs. expected earnings growth, NVDA, AMZN, META look more attractively priced than others.

7. Crypto: Spot & Futures

Crypto prices are dramatically lower overnight, with ETH dropping nearly 6% and BTC over 3%.

My read is that the movement is more technical than fundamental driven. As BTC failed to break above the price channel established since March, the market needs to recalibrate and retest the middle of that channel.

You could argue it’s forming a bull-flag or reverse head-and-shoulders, unelss $55k is broken.

Both BTC and ETH futures have also fallen.

8. Oil & Gold

WTI (US Oil) has further risen today, with the spot price breaking above $80.

If WTI sustains above $80, we could see a rebound in the headline CPI. When WTI is over $80, CPI has been higher than 2% two-thirds of the time.

Gold relatively quiet today.

A note on BTC vs Gold. While BTC is deemed to be the “digital gold” and “store of value”, the two asset share close to 0 correlation in their price moments.

Thank you for joining me on this journey.

Please feel free to share any suggestions or comments, either directly through email or in the comment section. Your support is really appreciated.

— Yimin

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Please be careful and do your own research.

References

Barkin, May 6, 2024 at Columbia Rotary Club in South Carolina

Kugler, April 3, 2024 at Washington University in St. Louis.

Collins, May 8, 2024 at Massachusetts Institute of Technology event

Goolsbee, June 14, 2024 at Iowa Farm Bureau Economic Summit in Ankeny, Iowa

Reply