Hi friends,

Today, Amazon stock (AMZN) rose by 3.9% (timestamp: after the close, June 26, 2024), surpassing the recent all time high in May.

The past 3 years have been a frustrating journey for AMZN investors. After a rollercoaster ride in 2022-23, the stock was only back to the 2021 level in the last two months. AMZN’s performance relative to the 2021 high lagged GOOGL, META, MSFT, and AAPL.

Now the key question: will AMZN finally break out and sustain above the May high?

As usual, we deploy both chart analysis and fundamental analysis to get a full view of where AMZN could be headed next.

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Please be careful and do your own research.

1. AMZN’s chart looks bullish

AMZN Weekly Charts

Click here for the full-size chart.

From the December 2022 low, AMZN looks to be progressing well into the heart of wave iii of 3.

Wave 3 targets the $240 region (the 1.382 extension of wave 1, placed at the wave 2 low), with a wave 4 pull back expected at $190, before finishing wave 5 at around $280 (the 1.764 extension of wave 1 placed at the wave 4 low).

For those unfamiliar with the Elliot Wave Theory, you may recognise this technical pattern of breakout & retest. The current resistance at $190 turns into support, and the stock runs 100% of the initial rally from the breakout.

Click here for the full-size chart.

2. AMZN fundamentals appear attractive relative to peers

EV/ NTM Revenue multiple attractive given forward growth

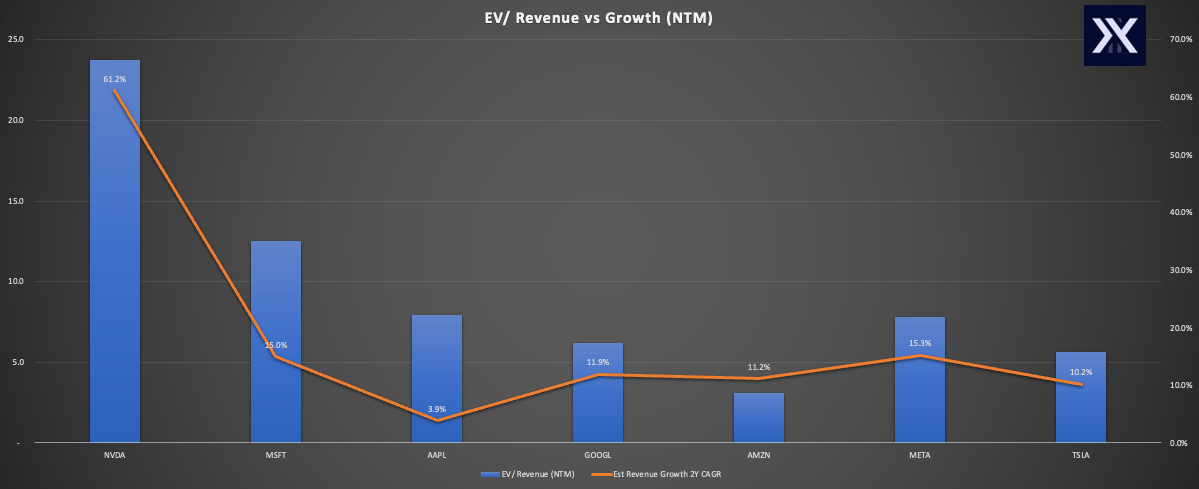

We compare AMZN with both its Magnificent 7 peers and its E-Commerce competitors below. This is because AMZN has both E-Commerce and Cloud businesses.

AMZN vs Magnificent 7 peers

We see that AMZN’s forward EV/ Revenue multiple appears cheaper than the other mega-caps.

AMZN vs E-Commer peers

Moreover, AMZN’s multiple looks attractive compared with SHOP, EBAY, ETSY too given the growth rates.

PEG ratio also stands out

The story continues when we compare AMZN’s Price-to-Earning ratio versus its 2-year-forward Earnings-per-Share growth.

AMZN’s PEG vs Magnificent 7 peers

Among the Magnificent 7, AMZN’s EPS growth of 40% 2-year-CAGR is only behind NVDA. It looks like a slightly worse valuation than NVDA but a much better valuation than MSFT and AAPL.

AMZN’s PEG vs E-Comm peers

AMZN is expected to growth its EPS at a faster rate than SHOP, while enjoying a 1/3 cheaper PE multiple.

What does the Discounted Cash Flow (DCF) model say?

The current price of ~$190 has priced in the assumptions that AMZN will grow 9-11% per year in the next 10 years. AMZN should target a long-term EBITDA margin of 26% and FCF margin of 16%. CapEX is estimated to be 10%, similar to today. The perpetual growth rate for the terminal value is assumed at 3%, which is slightly aggressive given the Fed estimates the GDP to expand at 1.8% in the long-run.

These are rich-ish assumptions, but that’s the market we are in today. Valuations are floaty across the board.

For AMZN to justify the $280 share price, we need to see sales growth maintained at the low to mid teens. EBITDA margin gets lifted to high 20%, and CapEX shrinks to 6-7% in the long run. This will provide a long-term FCF Margin of over 20%. This likely requires much more of the net revenue to come from AWS, which is handsomely beating these margins currently.

Indeed, if the chart technicals turn out true, AMZN may reach the $280 without ever justifying the fundamental valuation. After all, price is also driven by momentum and sentiment.

Tools I find useful:

TradingView: I use TradingView for all my chart analysis. It is very fast and simple to play with, including the mobile and desktop apps. Sign up here to get $15 off your new TradingView plan.

Koyfin: I use Koyfin for stock screening, comparative analysis, and fundamental analysis. It provides very comprehensive data and features at a reasonable price. Sign up here to get 15% discount off all Koyfin plans.

Fastgraphs: I find Fastgraphs very useful in gauging whether a stock is underpriced or overpriced versus the fundamentals. Sign up here to get 25% off using the coupon “AFFILIATE25” at the check out.

A quick “Thank You”

I really appreciate your support for this newsletter.

Please feel free to share any suggestions or comments, either directly through email or DM me on X

— Yimin